The T16L ION pallet truck and the Linde D08 ION double stacker are powered by lithium-ion batteries. |

Melissa Barnett examines the rise of new energy sources, how they address many of the recurring problems of the old technology and whether they are really here to stay.

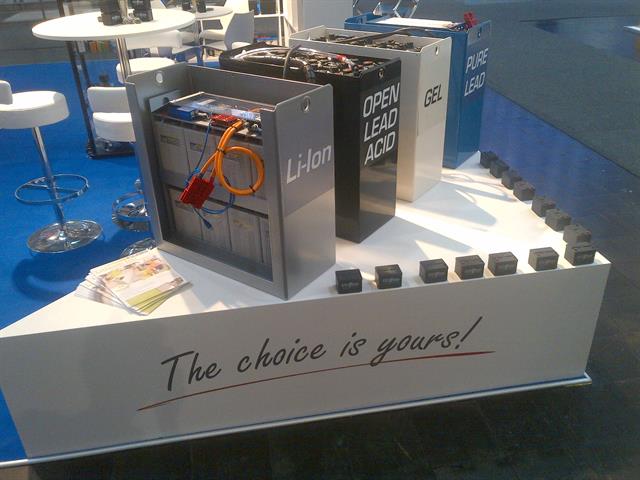

In the usual way of change and innovation, what were once new energy options for materials handling equipment are now almost standard. Lead acid batteries are still popular and widely used, but they are beginning to feel like they are getting closer to their use-by date. Equipment manufacturers are already designing forklifts of the future that build lithium-ion (Li-ion) capacity straight into new equipment. Linde senior vice-president - product management Stefan Prokosch says that his company is working on designs that adapt to the ergonomic potentials of Li-ion. Maxime Vidricaire, chief business officer for Canadian battery manufacturer Stromcore, says that OEMs are looking to maximise performance by designing forklifts with the counterweight outside the battery compartment, allowing the maximum number of lithium modules to fit into the allocated space.

Why the search for alternative energy solutions? Eaxtron battery connector |

Alexandre Bourdy, international sales manager for French battery connector manufacturer Eaxtron, says there are quite a few reasons for people to look for alternative energies, but the main one is efficiency - in use, cost and maintenance.

"With new energies, companies aspire to use their trucks almost 24 hours a day, seven days a week without having to replace their battery and with shorter charging time," says Bourdy. He believes safety is the second top reason. Prokosch agrees and explains that lithium-ion battery technology has distinct advantages, especially for customers with multi-shift or energy-intensive applications. In addition, unlike lead acid batteries, lithium-ion batteries create no potential battery gases during the charging process.

Vidricaire believes that new energy solutions offer a path to full productivity, without concern for the battery's ability to keep up. "As these new technologies come of age, it is apparent that end-users have been eagerly awaiting a solution," says Vidricaire.

Tameka Flores, senior marketing manager for US company Posicharge, says there is a slow but changing mindset among corporate executives. "In the past, there was a trade-off of sacrificing profits in order to meet or exceed environmental initiatives. This is no longer the case. It is now simply where these new technologies can win ROI alone, as well as add significant improvements on reducing the environmental impacts of their operations. Adding a green checkmark to the company is more of a reality than ever before," says Flores.

Lithium-ionLinde has significantly expanded its portfolio of lithium-ion drive industrial trucks in the face of sharply rising demand, according to Prokosch. He says customers are looking for industrial trucks fitted with Li-ion batteries because the technology is more reliable and extremely energy efficient. In addition, Li-ion enables higher performance in heavy-duty applications, which supports customers who want to change their application from IC to electric trucks.

Tailift PFG25 |

James Kuo, product planning director for the Tailift Group, believes Li-ion batteries are the most successful new energy because it is a mature technology already adopted in various other industries. "I believe in a few years, as the supply for Li-ion increases, the price difference between lead acid and lithium will reduce dramatically, and eventually Li-ion will replace lead acid as the standard - much the same as LED technology has replaced CRT in the television market," says Kuo.

One explanation for the success of lithium batteries is their compact size, which is important as the market demands smaller and more efficient machines, says Bourdy.

Investment, says Alexander De Soete, sales manager with Belgian company Battery Supplies, has influenced the improved marketshare of lithium-ion batteries. "Li-ion batteries are more successful because it has been cheaper to invest in the technology over the last few years, thereby attracting more investment. In contrast, investment is still very low in hydrogen technology," De Soete notes.

Vidricaire says that while hydrogen fuel cells got an early start, after a decade on the market, they still account for only 1% of forklifts in operation. He believes that range, safety and charge rates for lithium have now reached levels competitive with hydrogen at a fraction of the investment cost. "In fact, I believe, they are also outcompeting lead acid in a range of warehouse cases. If lithium continues on its current cost trajectory, it holds the potential to overhaul the (materials handling) market within the next five to 10 years," he predicts.

Hydrogen and other alternatives Battery Supplies energy source options |

While Li-ion appears to be the favourite of the energy-storage contenders, it is not the only option on the market. Hydrogen fuel cells are probably the most well known and there are a number of other alternatives in research stage. Andy Marsh, chief executive officer of US hydrogen cell manufacturer Plug Power, says that all solutions will be needed as the world transitions to global electrification, and hydrogen fuel cells will be a key component in the equation.

Hydrogen is an abundant resource; in fact, the most abundant element in the universe. It produces clean energy with only water and heat as by-products. As well as being environmentally cleaner, hydrogen fuel cells' main advantages over lithium batteries are a considerably faster charging time and having 200 times the energy density of a standard lithium battery. This means that hydrogen-powered cars or equipment can run for similar distances as regular diesel- or petrol-powered vehicles, something lithium-ion batteries still can't match. Hydrogen fuel cells also maintain their efficiency when working in cold environments and don't get sluggish just before refuelling.

Plug Power Freezpak refuelling |

Marsh says that Plug Power recently signed an expanded deal with US retailer Wal-Mart to supply 30 additional hydrogen fuel cell solutions, over three years, across Wal-Mart's North American distribution centres. Wal-Mart currently operates 6,600 units, the largest fleet of hydrogen powered vehicles in the world. This follows an earlier USD600 million deal with Amazon to trial hydrogen fuel cells in 10 of its US warehouses. "End-users have embraced them because they can see the ROI on Plug Power's hydrogen-based solutions - cost savings, smoother operations, increased performance and synergies with the broader goals for their business," says Marsh. Wal-Mart has been able to grow and maintain the largest fleet of hydrogen fuel cell-powered electric vehicles in the US retail industry. Jeff Smith, senior director of logistics maintenance and purchasing services for Wal-Mart, believes that Plug Power's materials handling solutions represent a critical component in Wal-Mart's supply chain."Hydrogen fuel cell technology, coupled with Plug Power's innovative fuelling stations, has proven to be a reliable, cost-effective alternative to traditional energy solutions," says Smith.

"We see a growing market opportunity for our power and fuelling station technologies within the materials handling segment, as well as new mobility applications worldwide," says Marsh.

Prokosch says Linde have been offering hydrogen fuel cell units as customised options since 2010 and that hydrogen fuel cells impress in many ways: refuelling times of just a few minutes, low maintenance, zero emissions in operation, and high efficiency in both full and partial loads.

Toyota Industries Corporation announced in January last year that it was trialling two, 2.5 T hydrogen-powered Toyota forklifts at its Motomachi Plant in Japan. The trial and the gradual introduction of 170 hydrogen-fuelled forklifts by 2020 is designed to reduce CO2 emissions from its plants to reach the company's Plant Zero CO2 Emissions Challenge. Toyota explains the fuel cell and its hydrogen tank fit in a casing whose dimensions, weight and connections are identical to those of a conventional lead acid electric battery. This casing is inserted into the forklift, in place of the battery, and is only removed for annual servicing. The fuel cell takes approximately three minutes to refill.

The trial is a joint venture between Toyota and the Japanese government in an effort to promote hydrogen fuel cells in industrial vehicles.

Another technology that may challenge hydrogen fuel cells and Li-ion batteries in the future is an idea being developed by the creator of the lithium battery, John Goodenough. Goodenough has been researching and developing a sodium battery that will last longer, charge faster, hold 10 times the energy and cost a fraction of the price of lithium batteries. The sodium battery design replaces the lithium anode with sodium (common salt) and the liquid or gel electrolyte with solid glass. The R&D is still in the early stages and, like its lithium cousin, could take another 10 years to reach a commercially viable stage. Many are still sceptical about the science and do not see it as a viable alternative for the time being.

Hoist manufactures electric forklifts to 25T |

Colleen Burke, marketing co-ordinator for US manufacturer Hoist Liftrucks, says that they have received more enquiries about electric forklifts in recent years and, for this reason, Hoist has added four new electric-powered forklifts to its product line, one with a lifting capacity of up to 25 T. "The use of alternating current (AC) in high-capacity machinery has come out of the shadows cast by direct current (DC) electrical energy recently. This technology has been around, but is newer in the 7 T and above machines that Hoist manufacture. AC has proven to be more effective in our machines due to lower maintenance costs, such as elimination of wire brushes used in DC, and a longer life-span," she explains.

The challengesAs Bourdy points out, new technologies are also victim to a logical scepticism and most of the companies stay with the classic lead battery technology until being convinced that the new solutions fill their expectations of low cost, high efficiency and minimal environmental impact. "The cost of access to lithium-ion technology is also a reason why, with all the new energy sources and related advantages emerging, lead batteries are still number one on the market. However, global battery-making is expected to double by 2021, according to recent statistics and the cost of lithium technology should almost halve in the meantime," adds Bourdy.

De Soete isn't convinced that lead acid batteries are on their way out anytime soon for similar reasons: "For sure, markets change, and the changes go faster than we think. But not everybody is prepared to pay more for a Li-ion battery, and not everybody even needs a Li-ion battery," says De Soete.

Hydrogen, although touted as cleaner and cheaper, has issues with storage, distribution and even production. Linde's Prokosch believes that favourable conditions exist for hydrogen fuel cell use when it is produced as a "waste product" in a company's production process or if the company already has a hydrogen filling station. However, he still believes lithium-ion technology is one step ahead of fuel cell technology. "This will remain so for the next few years because, for the time being, the Li-ion technology allows a wider field of application. From the energy efficiency point of view, fuel cell requires the next technology push to close the efficiency gap to Li-ion," says Prokosch.

PosiCharge systems from AeroVironment Inc are being used by Nestl�. |

Flores believes that the electric solution is a solid value proposition currently and the prime energy sources are reliable and predictable. "Innovations like automated guided vehicles and cheaper lithium solutions will keep lowering the bar for converting to these technologies, eventually establishing electric vehicles as the standard moving forward."

Materials handling is an industry that embraces new technology with enthusiasm and it is the end-user that needs convincing that innovation is the way to go. When the bottom line matches the ROI, there is no doubt end-user and manufacturer will agree - it is only a matter of time.

Additional information and a special 'THANK YOU' to our contributors:NO FUTURE WITHOUT BATTERIES

Battery Supplies: website

------------------------------------

STROMCORE: LITHIUM FORKLIFTS HAVE FINALLY COME OF AGE

Stromcore Energy Inc. : website

------------------------------------

HOW TO ENHANCE SAFETY IN CHARGING ROOMS WITH BATTERY CONNECTORS

Eaxtron: website

------------------------------------

Linde Material Handling GmbH: website

------------------------------------

Tailift Group: website

------------------------------------

Hoist Liftruck Mfg. Inc.: website

------------------------------------

Plug Power Inc.: website------------------------------------

Did you enjoy this feature? Our next feature article will focus on Fleet and Stock Management. Enquire about contributing here.