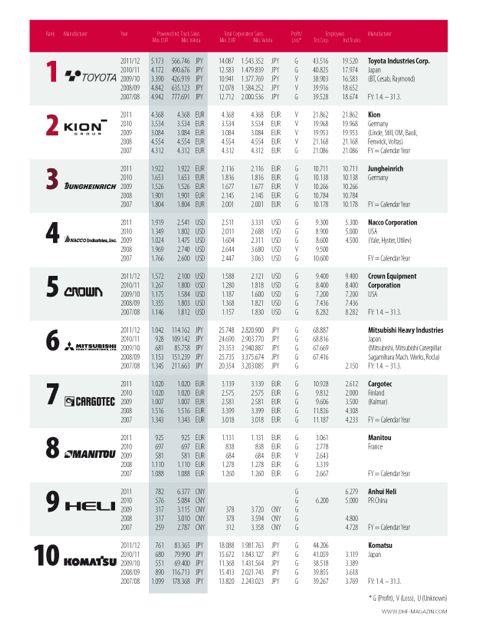

The top 10 industrial truck manufacturers in dhf-intralogistik's world ranking list. |

Anhui Heli has climbed its way up

dhf-intralogistik's latest world ranking list of industrial truck manufacturers and now holds ninth place, compared to 11th place previously.

The Chinese manufacturer, which produces about 100,000 industrial forklifts annually, aspires to become a 'first-class brand' and to be placed among the top five of the world's industrial truck manufacturers.

Based on

dhf's survey, Anhui Heli achieved 25.4% sales growth - from CNY5.084 billion (USD815 million) in 2010 to CNY6.377 billion (USD1.022 billion) - in 2011.

"Based on our survey, we also learned that profits were achieved, although we do not know what level these reached during this year," the world ranking list report said.

The top five in 2011 retained their places for the latest ranking list

(Forkliftaction.com News #556). Toyota, the world number one, grew its lead over the KION Group from EUR638 million (USD853 million) to EUR805 million (USD1.076 billion). The world leader achieved annual forklift sales in its financial year 2011/2012 of JPY566.746 billion (USD6.049 billion).

KION of Wiesbaden, Germany, which comprises the Linde, Fenwick, STILL, OM STILL, Baoli and Voltas brands, saw its sales revenue grow by about 24% to EUR4.368 billion (USD5.844 billion) in the reporting year. The main revenue earner for the group, contributing 65% to group annual sales, was the Linde Material Handling segment.

Jungheinrich, which was third-placed, achieved group annual sales of EUR2.116 billion (USD2.831 billion) in the 2011 financial year.

NACCO almost closed the gap with the German company after achieving sales revenues of USD2.541 billion.

Family-owned Crown Corporation does not publish its financial results, but from

dhf's questionnaire, Crown achieved sales of USD 2.1 billion in the reporting period of 1 April 2011 to 31 March 2012.

Mitsubishi Heavy Industries (MHI) experienced a drop in total sales from JPY2903.8 billion (USD31.0 billion) to JPY 2820.9 billion (USD30.1 billion). Its nett earnings also fell by almost 23% to JPY24.5 billion (USD262 million). However, annual sales of MHI's industrial forklifts rose from JPY109.142 billion (USD1.165 billion) to JPY114.162 billion (USD1.219 billion).

Seventh-placed Cargotec saw its 2011 net profits rise by 91.4% to EUR149.3 million (USD199.7 million) on the back of sales revenues of EUR3.139 billion (USD4.198 billion).

For the first time since 2008, French manufacturer Manitou posted profits. Its annual report shows nett earnings of EUR36.5 million (USD48.8 million) in the 2011 financial year and total annual sales of EUR1.131 billion (USD1.153 billion).

The Japanese Komatsu Group, which celebrated its 90th anniversary in 2011, experienced a 7.5% growth in total sales revenues to JPY1981.763 billion (USD21.2 billion).

Sichelschmidt Material Handling GmbH, specialising in explosion-protected industrial forklifts, has been represented in the ranking list for many years. However, the company announced this year it was 'not a manufacturer of normal forklifts' and no longer wants to be included in the list.

Another manufacturer that has left the list is Danish company Dantruck A/S. The company was badly affected by the economic crisis as the segment serviced by the Danes declined by as much as 80%. The company placed itself into liquidation in 2011

(Forkliftaction.com News #541). Jungheinrich, which had partnered with Dantruck for the production of 6-9T counterbalance forklifts, acquired the rights to produce and sell the large forklifts made by the Danish manufacturer

(Forkliftaction.com News #593).

A new company on the list is Paletrans, a Brazilian company based in São Paulo. Dhf estimates the 28th-placed Paletrans to be the biggest manufacturer of forklifts in Latin America.

The ranking is based on sales revenue from industrial truck sales.