Image courtesy of 123RF |

Melissa Barnett looks at the prospects for the North American materials handling market.

Before the COVID-19 global pandemic struck, the materials handling sector across North America had sustained steady growth to 2019, to peak at USD24.7 billion. The market was expected to maintain an upward trajectory towards 2025, to USD29 billion, according to IBIS World research. Unfortunately, the pandemic has affected all manufacturing negatively in North America, including materials handling equipment, with IBIS now predicting a 12% decline in this particular market, but it's not all gloom and doom.

Flex and adaptVice president of marketing and communications for US industry organisation MHI, Carol Miller, says that the materials handling industry is vital to maintaining social and economic stability by supporting fulfilment and e-commerce. Director of membership (MHI), Alan Primack, adds: "No-one knows how long this new normal will last but, in general the manufacturing market has rebounded nicely - but all companies are treading lightly with their reserves so they can continue to be flexible and fluid within the market that will probably continue to have some bumps for the foreseeable future.

"MHI like most associations have pivoted along with their members and presented their networking and education options virtually throughout the pandemic. From increasing our webinar education significantly with exclusive bi-monthly webinars with our economist to highlighting our companies on social media that performed successful pivots, MHI has tried to be there for our members as vital source of information through these unique times. We launched an app and an online forum for our members to connect and learn about upcoming events and we continue to provide timely information through our various e-zines on the marketplace," he explains.

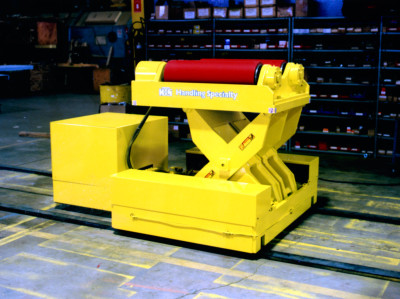

Mike Poeltl, marketing business development manager for Handling Specialty Manufacturing,

Handling Specialty Manufacturing steelworks AGV |

says his company was classed among Canada's Government-dictated essential industries, "so we have been able to work through COVID-19, but at a much-reduced pace and with a much smaller labour force. Layoffs happened within the office and on the shop floor, seeing employees working from home." Poeltl also says that Handling Speciality Manufacturing had a number of projects coming down the line and the backlog held them in good stead over the past year.

Guido Cameli, product support and warranty manager of fellow Canadian company, Liftking Manufacturing, says that one of the major challenges from lockdown has been interruption to the manufacturing supply chain. "We've met this challenge by increasing our stock levels to provide a buffer in case of supplier disruptions and have broadened our approved supplier list both locally and internationally, particularly for hydraulics, electrical components and structural steel. Liftking is also concentrating on identifying commonalities between parts that can be used for substitutes in case our normal supply is affected. "We are pre-assembling major components to be kept in inventory (and) in case there is a disruption to our workforce, we will be able to operate at a lower headcount," explains Cameli.

Liftking power slab lift |

The pandemic has shown just how reliant global manufacturing is on imported parts and components and while the US government has advocated over the past two years to bring manufacturing back to the US, it isn't that simple. Manufacturing is no longer vertically integrated, where one company can design and manufacture the majority of its parts for the completed unit. Technology puts pressure on the process, as one company seldom has the skills and resources to cover the range of manufacturing specialties required. Complicating the process further is the need for specialist resources like lithium and practices like lean production - where manufacturers keep a reduced inventory on-site.

There are a number of strategies that companies can deploy to mitigate the supply chain challenges, including diversifying sources of supply and buffering stock. They must also be flexible. Pete Drake, senior vice-president of operations Americas at Cascade Corporation, says that having supply chains in different countries working hand-in-hand with local manufacturing allows Cascade to provide responsive and timely manufacturing. Cascade has six manufacturing sites around the US, with a well-established domestic supply chain. Drake points out that having a flexible workforce has also been key.

Cascade has seen an increase in demand for custom products and this has put a strain on the company's design and production teams, he notes. "Cascade's workforce has had to adapt quickly from on-site to virtual settings. We have utilised digital resources such as video-conferencing and meetings and other communication tools and have ongoing virtual training between our global teams - including engineering, service and sales. This has enabled our workforce to continue to exchange ideas (and) valuable knowledge and maintain productivity.

RAVAS US manufacturing complex,Twinburg Ohio |

"The willingness of every staff member to adapt has been key to RAVAS's strength this year, says Jose Sarruff, national business executive Americas for the Dutch-based mobile weighing scale company. RAVAS acquired the former Lift Truck Scale facility in Twinsburg, Ohio in late 2019. "We saw an initial disruption in operations while we sorted the safety processes out to protect our employees. After that, our European and US teams worked creatively together to ensure that raw materials reached the US production facility, as we strive to manufacture all our products intended for the Americas in Ohio. Supplier diversification was a key opportunity at this time," says Sarruff.

Shannon McWilliams, vice-president of sales and marketing for Integrated Warehouse Solutions, agrees that staff flexibility has been vitally important during recent times. "We are fortunate that the vast majority of our products are made here in the USA and we have limited challenges importing product from overseas. With this in mind, we have the ability to manage, monitor and adjust our people and process where applicable. This enables us to flow production, based on the needs of our customers. Our strategy has been to have a relentless focus on our employees and their overall health and safety. While we've had some challenges, overall, we've been able to deliver on all of our requirements and have had several record-breaking months this year. "It's critical to listen to your employees and customers and plan for uncertainty," says McWilliams.

Telematics manufacturer Collective Intelligence Group supplies its equipment to a large range of US-based manufacturing companies. Its US product manager, Chris Reeves, says that the incentives to return manufacturing to US shores have given many of its US operations more flexibility in sourcing materials, resulting in increased market opportunities for the company. Not deemed an essential service, Collective Intelligence used the mandatory shutdown period to build in-house inventory and to update firmware which would eventually be pushed to end-users. "We use this same strategy when dealing with customers, by offering retrofits for existing equipment. This provides immediate compliance and safety for their business, regardless of supply chain issues for new equipment," Reeves explains.

Bolzoni's carton clamp wine box handling in warehouses and logistic centres |

Bolzoni is another European manufacturer which has invested in local manufacturing facilities closer to its North American market. Its manufacturing facility in Sulligent, Alabama has manufactured over one million hydraulic cylinders over the last five years. John Regan, vice-president sales and marketing, believes that forecasting for potential customer needs prepared the company for commercial sales growth over the past year. "Using data on the history of purchased equipment, as well as tracking our sales pipeline activity, allowed us to prepare materials for quick lead times and agility within manufacturing. Bolzoni instituted a robust stocking plan for common spec attachments, allowing for off-the-shelf availability to support critical businesses during the pandemic. "We continue to closely monitor industry impacts over this time through our sales and marketing teams in order to be prepared for customer requirements," says Regan.

The five-year forecast - recoveryWhatever the past year may have taught business, particularly those in manufacturing, the two biggest lessons must be to prepare for the unexpected and that rapid response and adaption are vital. When times are good, businesses can become complacent. Those businesses which regularly update systems and processes, customer service expectations and company standards are the ones who appear to be weathering the times the best, and are, in fact, the companies that are always most resilient.

Integrated Warehouse Solutions |

MHI forecasts 2021 to be a year of recovery and improvement although it might be mid-2022 before GDP reaches the same level as in Q4 2019. McWilliams is very optimistic about 2021-2026, saying he believes that the US is beginning to see a surge in demand for products made in the USA. "We believe the customer is driving the need and that's based on supply metrics; reduced lead-time, minimum/maximum levels and safety stock. Quality unequivocally plays a huge role in this as well.

"If this trend continues, manufacturers will need to plan and invest to make sure they can deliver a broader range of US-made products," he says, adding that Integrated Warehouse Solutions is investing in its business to meet the demands of the materials handling market. "We also plan to extend our business into other segments that are beginning to show signs of recovery," says McWilliams .

Surprisingly, expansion seems to be in the strategic plans of a number of companies

Forkliftaction spoke with. Sarruff says that RAVAS is also planning to expand operations. "I expect the materials handling industry to see record numbers moving into 2022, and, as well, through to 2030. RAVAS is preparing for this upcoming business boom by adding over 60,960 sqm globally in new floor space to accommodate our growing sales force and increased production forecast," says Sarruff.

Liftking's Cameli is more cautious: "At this point, it is difficult to say what will happen. I feel comfortable that we will weather the storm and have put processes in place to be in a better position when the time comes to resume business as usual," he says.

Collective Intelligence Group IQ 360 |

Collective Intelligence is already seeing a significant increase in North American manufacturing, says Reeves. "The shutdown period was devastating to many businesses; however, feedback we are receiving indicates the recovery may be better than initially predicted, especially in areas where most restrictions have been removed. There will, of course, be delays, but businesses have adjusted their operations to deal with the virus and keep employees safe while maintaining production schedules," he says.

Automation has been the bright light on the horizon for many in the sector, unaffected by virus outbreaks or shutdowns. "I believe the materials handling sector will continue to thrive as automation technologies continue to improve safety and efficiency," says Poeltl. "It will always be an important industry so long as people and product need to move from one place to another."

Bolzoni's expectation is that 2020 will have a major impact on how industries view their business in both planning and innovation. "We expect our customers to use the tech tools, data analytics, AGVs and alternative power supplies available to them to create lean business processes," explains Regan. He believes that the new workplace dynamic will result in lower overheads and better productivity. "The transition to remote learning and work from home will hopefully teach us to connect without personal interaction. I expect organisations will grow with these practices, allowing freedoms for both employers and employees. The reduced costs of commuting, and in-office disruptions could allow for better productivity, while allowing for a better work/life balance for the employee. The benefits for the employer are obvious - increased employee productivity and lower overhead costs. All of these factors should leave the materials handling businesses in a position for recovery. We expect our business to stay strong in 2020 and beyond," says Regan.

Cascade multiple load handler on an AGV |

Cascade's Drake also has confidence in a robust industry sector recovery. "We are optimistic that the materials handling sector will recover and continue to grow. As a relatively flexible industry, we have been able to pivot and respond to increasing demand in varying industries as they adjust to a new normal. In particular, growth in e-commerce activity has resulted in an increased need for new types of materials handling solutions. E-commerce growth along with an increased focus on health practices has also accelerated automation in order to maximise productivity. I believe Cascade's spirit of innovation and global footprint has allowed us to anticipate and respond to the trends in technology and market activity," he adds.

At a time of such uncertainty and anxiety, it is reassuring that the ever-perennial materials handling sector remains optimistic and confident. North American manufacturing will certainly have its challenges over the next few years, but it seems the sector is resilient and up for the challenge.

THANK YOU to these experts for their valuable contributions to this feature:Integrated Warehouse Solutions masters custom-engineered solutions

Integrated Warehouse Solutions: website------------------------------------

Forklift telematics systems from the Collective Intelligence Group

The Collective Intelligence Group: website------------------------------------

RAVAS - Mobile Weighing Solutions That Deliver

RAVAS: website------------------------------------

Navigate Pulp & Paper Handling for Port Operations with Cascade

Cascade Corporation: website------------------------------------

Handling Specialty: website------------------------------------

Bolzoni S.p.A.: website------------------------------------

LiftKing: website------------------------------------

MHI: website