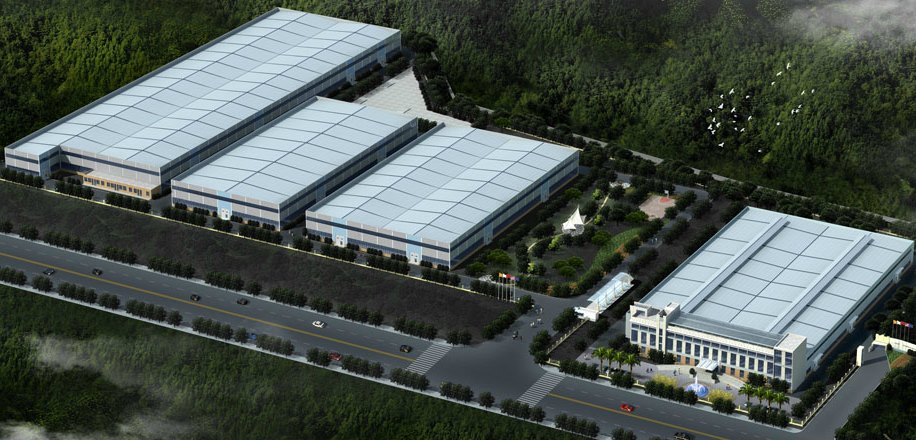

Maximal has nearly 600 employees and a 133,000 sqm facility in the Lushan Industry Area near Hangzhou |

Hyster-Yale Materials Handling has entered into a definitive agreement to acquire 75% of the outstanding shares of, and a controlling interest in, Zhejiang Maximal Forklift Company Limited through an indirect wholly owned subsidiary.

The stock is currently held by KNSN Pipe and Pile Company Limited and the price has been set at USD90 million, funded using Hyster-Yale's cash on hand.

The remaining 25% share of the new company, which will be named Hyster-Yale Maximal Materials Handling Co., Ltd, remains in the hands of Zhejiang Maximal Forklift senior management through Y-C Hong Kong Holding Company Limited.

Maximal, a privately held, Chinese OEM for utility and standard forklifts and specialised materials handling equipment which was founded in 2006, produces equipment under the Maximal and SAMUK brands. Maximal also designs and produces specialised products in the port equipment and rough-terrain forklift segments.

Maximal has nearly 600 employees, and its 133,000 sqm facility in the Lushan Industry Area near Hangzhou, southwest of Shanghai, has a current production capacity of 30,000 units.

The proposed transaction is a strategic action that is expected to expand Hyster-Yale's low-cost, global manufacturing capabilities, develop access to competitive component sourcing, further strengthen its utility and standard product portfolio by adding a wider spectrum of products to an already leading global materials handling business, and enhance the company's presence in both the China market, as well as in the growing global utility and standard market segments.

Although Hyster-Yale has been in the China market for a number of years, its marketshare has been limited and focused in the more premium segments. Maximal has achieved success in the utility and standard segments in this region, and this joint venture will allow Hyster-Yale to start reaching this expanded customer base.

This is especially important for strengthening Hyster-Yale's current China operations, which are operating on a scale below the level needed for long-term success.

For the year ended December 31, 2016, Maximal had revenues of approximately USD66.3 million, with domestic and export volume of nearly 6,000 units. Bookings and revenues in 2017 have increased nearly 20% over 2016.

Due to the investments that Hyster-Yale intends to make in the joint venture, the proposed acquisition, while currently profitable, is expected to be dilutive to its earnings in 2018 by USD5 million to USD10 million pre-tax due to additional investments in expense and capital needed to implement the company's integration plan.

The acquisition is expected to move toward being accretive in the medium term under conservative market share and synergy objectives.

The closing of the transaction, which is expected to take place during the first half of 2018, is subject to customary closing conditions and required regulatory approvals.