Over the past two years, Europe, along with the rest of the developed world, has felt the consequences of the Global Financial Crisis. None of the companies

Forkliftaction.com News spoke to for this report have emerged unscathed. However, as

Melissa Barnett discovered, some are doing better than others.

How are European materials handling businesses coping?The impact of the financial crisis has been severe and felt in every corner of Europe. However, some countries seem to be faring better than others. Countries in Eastern and Southern Europe appear to have suffered the most, while the rest of Europe and the UK have fared better. Even in the relatively stable Benelux economies, there have been reports of failing forklift dealers and many dealers have severely reduced their stock.

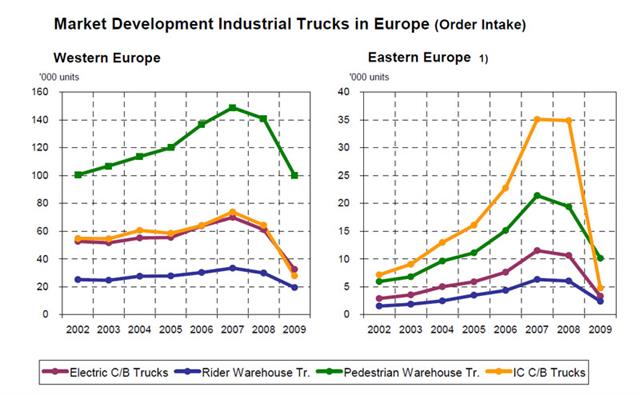

Published statistics from Fédération Européene de la Manutention (FEM) for 2009 point to an almost 40% drop in forklift sales across Western Europe, compared to 2008. However, most industry players that

Forkliction.com News spoke to put the figure closer to 50%. According to FEM, forklifts (52%), were more affected than warehouse trucks (30%) while the strongest decrease in demand was found in Spain, Germany and Italy.

FEM notes that in Eastern Europe, the drop was even more severe and amounted to a 70% decline, but Fred Märtsoo, spokesman for spare parts supplier, TVK (Baltic), believes in his area it is closer to 90%. "There was an unexpectedly severe downturn in total forklift sales in the Baltic countries, with local companies seriously affected," he explains. FEM stats showed that the decline in Eastern Europe was particularly felt by forklift trucks (82%) with warehouse trucks declining at 51%.

This information is backed by Bulgarian independent forklift distributor Danubia's, spokesman Dimitar Stefanov, a veteran of the industry, who says that in Bulgaria and Slovenia imports from the EU dropped to 660 units, down by a third from 2008 figures. Total sales of new forklifts (imports from EU, overseas and locally manufactured) was thought to be around 1,100 units in 2009 and 490 this year to date, but many of these, according to Stefanov remained in dealer yards. The FEM report showed that the hardest hit Eastern European countries were Russia, Ukraine and the Baltic States

FEM's 2010 update indicates a significant recovery to May, with market volume increasing almost 74%. According to Forkliftaction.com News sources, this translates into just over 100,000 units, with Germany constituting 23% of the sales, France 19% and Italy 14%.Linde, happily reports that demand in the second half of this year has exceeded earlier expectations.

European forklift statistics

Source: FEM |

FEM, recently held its 33rd conference in Istanbul, Turkey, Europe's sixth-largest economy, with a focus on the Turkish materials handling industry. In that part of Europe, the FEM notes that although sales are not yet back at peak 2008 levels, there is firm evidence of cautious recovery. Sales to date in 2010 have been 6,400 units, USD66million - up from 4,400 in 2009, and are predicted to climb to 8,500 units in 2011. Forklift sales in Turkey topped 8,305 units in 2008.

One of the unforeseen consequences of the recession has been the impact on local banks and finance companies, resulting in previous lines of credit for new purchases and infrastructure drying up. Badly affected have been the more fragile economies, like the Baltic States whose governments have been unable to implement stimulus packages.

Having ready access to finance has been greatly reduced by the GFC and it is usually the SME's that suffer. For Lisman Vorheftrucks in the Netherlands, the fact that they are a family owned business and can call on family funding has allowed the company to implement long-term planning. As Koen Lisman explains, "ready funding is an advantage in a climate where 'cash is king', enabling our business to make good deals quickly and giving us a competitive edge".

Strategies for weathering the GFCAlthough the GFC caught many businesses by surprise, most have responded with adaptability, restructuring marketing and operational strategies to become leaner and more efficient.

It is evident that a return to good, old-fashioned customer service has been the most successful marketing tool, underpinned by customer and brand loyalty.

European economic weather map |

More traditional means of survival have also been implemented. As Märtsoo explains, "at TVK, maintaining marketshare has not been so critical, just surviving has been". TVK, along with most other European materials handling operations, was forced to drastically reduce staff, letting go up to 30% of its staff. Linde admits to also reducing staff, but keeping a core of specialised personnel. Detlef Sieverdingbeck, head of corporate communications at Linde, explains that the company "adjusted capacities, restructured and optimised the way we do things. We became more streamlined, reduced staff but kept core specialised staff".

Sieverdingbeck further supports the idea that in times of crisis, customers rely more on brands and companies with excellent performance, low lifecycle costs and a very close-meshed, reliable service network.

Companies have rationalised their advertising strategies and visitor numbers to exhibitions have been down. However, attitudes may be changing, at least in the UK. IMHX, the next event on the industry calendar, scheduled for its new slot of November 16- 19th, has had encouraging feedback. As of this week, over 300 exhibitors were expected to attend IMHX.

Meanwhile, others have spent their advertising budgets on very specific marketing tools such as customer mail-outs, web-based advertising and Google search optimisation. Folkert De Graaf, sales and marketing manager for MSE-Forks in the Netherlands, regularly uses logistics portals such as

Forkliftaction.com and has recently implemented optimisation on the Chinese search engine Baidu.

Innovation in times of recessionThere is a theory that when sales are slow, more investment is made in R&D. However, few of the companies we spoke to were bringing new products onto the market this year. Many, including the German used forklift dealer, Richter Gabelstapler, have reduced investment in this area because of the difficulty in forward planning, while Martin Tychsen, spokesman for Danish attachments supplier E-L-M, believes that staff cuts have meant that many companies not only lack the financial resources but also the human resources to implement such programs.

There are some, however, that continue to invest in R&D, albeit more conservatively than in the past. It seems that most recent innovation is being driven by the need for greater efficiency, as well as environmental concerns.

McVicar says Combilift has retained its investment in R&D. Combilift introduced three new products this year, with its Combi-AM articulated Aisle-Master forklift and its Combi-CB both responding to the need for greater space optimisation.

Linde tells

Forkliftaction.com News that it too will continue to provide an important stimulus with new products and that it plans to unveil "a whole series of surprises" at industry showcase CeMat in 2011. In the meantime, it has developed new fuel-cell technology on display in the recently released three tonne range of electric and counterbalance forklifts, the E30. Linde is also looking into automated solutions, using camera and laser technology.

James Clarke, secretary-general BITA |

The British Industrial Truck Association (BITA) has been campaigning heavily during the recession for companies to take the opportunity to address safety issues. The organisation recently introduced the Design4safety award, recognising the importance of product design in improving safety standards, an area which is often neglected in times of economic uncertainty.

The award also reinforces the new British government directive 2006/42/EC, which came into force at the end of 2009. The directive requires an E or CE safety compliancy plate on all new and used machinery imported into the EU. BITA believes that the directive has two fundamental purposes: first and foremost to ensure product safety; second to maintain the competitiveness of European companies, by establishing a level playing field that adheres to free trade principles, while ensuring consistent safety standards and user protection.

A number of companies are indeed using the hiatus to improve workplace safety. MeVEA, a Finnish company specialising in onboard simulators, recently developed a training simulator for Kalmar. RTG operators can now train in a simulated environment without having to take a machine out of operation or compromise safety. Tuomo Raami, Kalmar project manager, believes the use of simulators is going to play an "increasing and cost-effective role in operator training". He also believes that this type of training has long-term company benefits as "operators quickly learn the correct techniques for lowering fuel consumption, reducing machine wear and tear and increasing efficiency".

Changes in demandThere have been significant changes in the types of forklift in demand since the beginning of the GFC. Anecdotal evidence suggests this has largely been in response to the need for greater efficiency and to new EU environmental directives.

Techna TR15 |

Electric and LPG forklifts, both new and used, now consistently outsell internal combustion engine (ICE) models. BITA reports that LPG forklifts are increasing in popularity in the UK, representing 30.2% of sales in 2010 and outselling diesel versions. This may also be in response to falling sales in the industrial and construction sectors. Warehouse equipment sales remained steady, although reports indicate that customers in this sector are holding onto their old machines for longer than they would normally - or buying used equipment. This has had the effect of pushing up prices of used equipment across Europe; particularly machines in good condition with low hours.

Smaller machines and multi-purpose warehouse equipment are also in demand as they tend to run more efficiently and reduce the number of machines required. McVicar believes that "customers are looking for better forklift utilisation in the work environment". This has prompted manufacturers such as Combilift to develop smaller, more agile multi-function equipment such as the Combi- AM and -CB series.

Demand for cheaper forklifts also grew, due to the difficulty in obtaining finance from financial institutions. Unfortunately, when the price of used forklifts is at near-parity with new Asian imports and when these are combined with extended warranties, the imports begin to look attractive, according to Paul Humber, director of TBS Forklifts, United Kingdom.

While some may see Asian imports as a threat to domestic machines, insiders like McVicar maintain that "European buyers do not buy on price alone, they also look to the resale value of the machine and suitability to their specific equipment needs". This is supported by a number of companies, including Spanish forklift manufacturer, Tecna, which notes that dealers are now changing their minds about cheap Asian imports and are more concerned with reliability and the availability of spare parts and service.

Lisman has noticed a small reduction in used Asian imports into Europe due, he believes, to the domestic markets of China and South East Asia requiring more stock as they recover from the global upset quicker and see Europe as a less attractive market.

Future directionsHigher sales and orders are expected in 2011, but no-one is anticipating a recovery of past glories.

John Meale, president FEM |

All believe that government incentive packages, such as the Italian government's capital tax write-offs on equipment, will help recovery. McVicar believes 2011 will be similar to 2010, with growth in newer EU member states, but reductions in orders due to general public spending cuts in Germany, France and the UK which will have a trickle-down effect. "The good news is that the weaker the Euro, the more export-competitive European manufactured equipment will be."

Some manufacturers continue to expand into new territories via partnerships. NACCO European managing director Ralf Mock believes Russia to be one of the most promising areas of growth. The recent agreement between Yale Europe Materials Handling and Universal Spetstechnica LLC (UST) is expected to create the most comprehensive distribution channel of any forklift manufacturer in the Russian Federation

Forkliftaction.com News #474. FEM president, John Meale, concerned about a double-dip recession, suggested recently, "we would advise our members to treat signs of recovery with not only enthusiasm, but a little caution. We certainly believe things will pick up in 2011, but until the economy stabilises, we are advising members to remain cautious about undertaking substantial investment".