ELFF treasurer Jeffry Elliott is optimistic

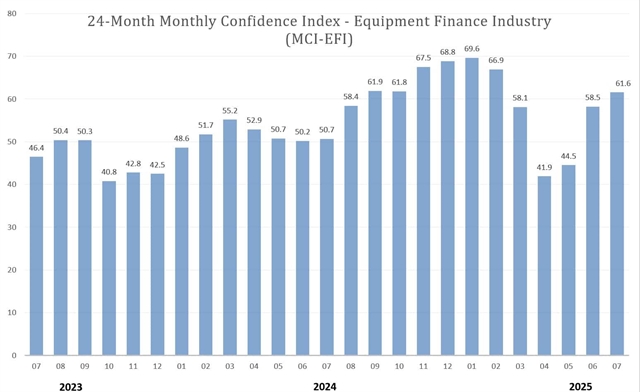

ELFF treasurer Jeffry Elliott is optimisticThe July Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI) has increased for the third consecutive month, revealing increasing confidence among industry participants.

The July MCI-EFI jumped 3.4 points month-on-month (m-o-m) to 61.6 basis points, according to the monthly qualitative assessment of the USD1.3 trillion sector produced by the Equipment Leasing & Finance Foundation.

The July survey, answered by key executives in the sector, also found that 37.5% of respondents believe business conditions will improve in the next four months, a sharp 7.9 point m-o-m increase, while the majority business conditions will remain the same in this period - 59.3%, a dip of 1% m-o-m.

The July confidence index has increased again

The July confidence index has increased again

Capex demand (demand for leases and loans) for the next four months is expected to increase according to 37.5% of respondents, an increase of 7.9% m-o-m, while most (58.3%) believe it will remain steady.

Of those surveyed, 20.8% expect to hire more employees in the next four months, a fall of 12.5% m-o-m while 70.8% foresee no change in headcount.

When it comes to the US economy, 91.7% assess it as “fair”, down from 96.3% last month.

Jeffry Elliott, CEO of Elevex Capital and Equipment Leasing & Finance Association Treasurer, says of his outlook for the near-term: “As we navigate the second half of 2025, concerns around inflationary pressures driven by escalating tariffs and the economic drag from intensified immigration enforcement are becoming increasingly pronounced”.

“These forces are not only straining supply chains, but also constraining labor availability - two critical components for productivity and growth in the commercial equipment finance sector.

“However, there is a silver lining on the horizon. The push for on-shoring and domestic manufacturing, while not an immediate remedy, holds long-term promise.

“As companies reconfigure supply chains and invest in US-based production, we anticipate a resurgence in demand for equipment financing—particularly in automation, logistics, and infrastructure.

“Looking ahead, the groundwork being laid today for a more self-reliant industrial base could usher in a new era of opportunity for the equipment finance industry.

The ELFF, in its Q3 economic outlook update published last week, revised its 2025 equipment and software investment forecast to 6.3% (up from 2.8%) and its US GDP forecast to 1.3% (up from 1.2%).

“Despite reasonably healthy topline employment, wage growth, and several other hard data indicators, real US GDP contracted 0.5% in Q1 2025,” the association states. “However, even as GDP shrank in Q1, equipment and software investment growth jumped nearly 22%, fuelled by businesses looking to front-load purchases to avoid new tariffs.”