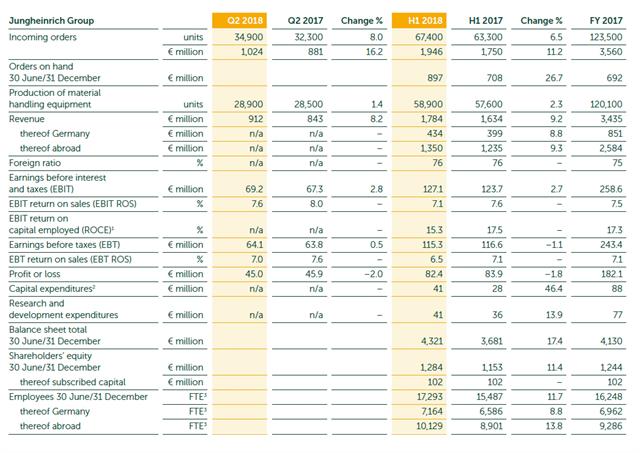

Jungheinrich performance at a glance |

The Jungheinrich Group is confident of continued strong performance for the rest of the year on the back of its positive results for the first half of 2018.

Hans-Georg Frey, chairman of the board of management of Jungheinrich, says: "Despite challenges such as the significant increase in staffing costs and prices of raw materials or the costs for the industry's most important trade fair, CeMAT, we again achieved highs for revenue, incoming orders and EBIT. In addition to that, expenditures for research and development increased considerably. The growth was significantly driven by the new truck business and after-sales services. With orders accounting for five months of production, we have a positive outlook for the second half of the year."

Frey notes that the global market volume for materials handling equipment increased by 15% year-on-year in the first half of 2018. This corresponds to almost 107,000 units.

Growth rates gained momentum in Q2 2018, particularly for warehouse technology equipment. The driving force behind the increase in market volume was demand in the Asian market, primarily in China. The market volume in Western Europe increased by 12%. Demand in Eastern Europe increased by 24%, thanks to Poland. North America grew 60%, mostly due to a significant increase in orders for IC engine-powered counterbalance trucks.

The warehousing equipment product segment recorded global growth of 18% (54,000) in trucks, with over 40% of this attributable each to Asia and Europe. The 11% increase in global market volumes of battery-powered counterbalance forklift trucks was driven above all by higher orders from Asia. Almost half of the global increase of 15% in demand for IC engine-powered trucks was also due to significantly higher orders in this region. In all three product segments, demand from the Chinese market was the driver for high growth rates across Asia.

Incoming orders in the new truck business, based on units, which includes orders for both new forklifts and trucks for short-term rental, totalled 67,400 units in the first half of 2018, equating to a year-on-year increase of 6% from the same time last year. By value, incoming orders for all business fields - new truck business, short-term rental and used equipment, as well as after-sales services, rose 11%.

Orders on hand for new truck business came to EUR897 million (USD1.04 billion) as of 30 June 2018, 27% higher than the previous-year figure.

Jungheinrich produced 58,900 trucks in the first six months of the current year - an increase of 2% from the first half of 2017.

Group revenue of EUR1.784 billion (USD2.07 billion) in the first half of 2018 was up 9% from last year.