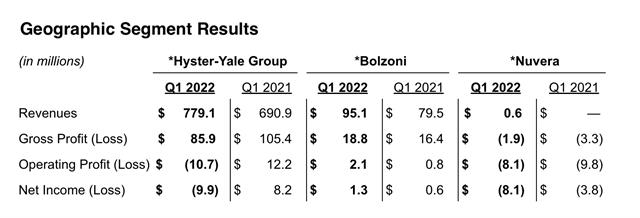

Hyster-Yale Materials Handling recorded a USD25 million loss for the first quarter of 2022 despite strong sales and shipments.

Revenues increased 13% to USD827.6 million, primarily as a result of an 18.7% increase in forklift shipments in the Americas.

The company’s latest financial statement notes that the global forklift market appears to have remained relatively robust in the first quarter of 2022. As a result, bookings in the first quarter of 2022 were still at very robust levels, but the company had fewer bookings than in the historically high prior-year first quarter.

“The company is focused on keeping the pricing of new bookings close to target margins based on anticipated costs at the time of expected production,” directors say.

The price increases flagged recently by Forkliftaction News are evident in the latest Hyster-Yale results, with the company indicating that “average bookings sales price per unit increased compared with both the 2021 fourth quarter and the prior-year quarter because the company continued to increase prices to offset material and freight cost inflation. These increased prices in turn translated into an increase in the current average sales price per unit of backlog in the 2022 first quarter over the respective prior periods as well”.

Like other manufacturers, Hyster-Yale reports ongoing parts shortages and supply chain disruptions which continued to constrain production in the first quarter. These factors also impacted on profitability, especially in EMEA, JAPIC and the Americas.

“Gross profit declined primarily as a result of an USD18.5 million increase in manufacturing costs over the 2021 first quarter as component shortages had a severe impact on the company's ability to produce and ship products from the backlog,” according to the results statement.

In the remainder of 2022, the company expects the global market to continue to decline from the historical highs of 2021, in part due to the impact of the Russia/Ukraine conflict, but to remain above pre-pandemic levels. As a result of this market outlook, the Lift Truck business is anticipating a substantial decrease in bookings during the remainder of 2022 compared with 2021, with the rate of decrease expected to moderate in the fourth quarter.

During 2021, the Company experienced production and shipment levels which were substantially lower than its objectives due to supply chain logistics constraints and component shortages. Some moderation in the number of suppliers with shortages occurred in the first quarter of 2022, but shortages are anticipated to continue throughout 2022, and possibly escalate again in light of the Russia/Ukraine conflict. Nevertheless, full-year shipments are currently expected to increase significantly in 2022 over 2021 given the company’s robust backlog and actions put in place to mitigate the impact of the supply chain constraints and shortages, but with the expectation that supplies of products or commodities are not constrained further as a result of the Russia/Ukraine conflict and recent COVID lockdowns in China.

Looking ahead, directors anticipate more red ink. “Given the continued component shortages due to supply chain constraints, significant material and freight cost inflation, and, more recently, the impact of the Russia/Ukraine conflict, as well as continued losses at Nuvera and the lack of tax offsets against pre-tax losses for the Lift Truck business and Nuvera, the company, on a consolidated basis, expects a larger net loss in the second quarter than in the 2022 first quarter, a lower but still substantial net loss in the third quarter and substantial net income in the fourth quarter of 2022.”