Chinese forklift sales are impacted by the global recession. |

The Chinese forklift market is tipped to become the world's largest this year. While the market experienced growth in the aftermath of the global financial crisis (GFC), forklift manufacturers were affected. Christine Cranney reports on how the industry is faring and the challenges ahead.

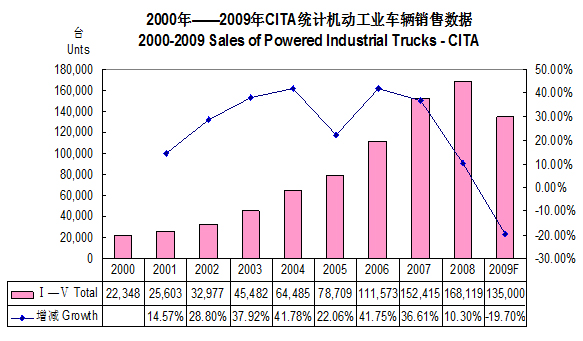

IntroductionAccording to China Industrial Truck Association (CITA) statistics, 2008 has been the peak year so far for the Chinese forklift market, with 168,119 forklifts sold. While Chinese forklift sales had been growing above 35% per annum from 2003 to 2007, sales climbed only 10.3% in 2008. In 2009, the forklift market experienced the effects of the GFC more severely and declined by 19.7% to 135,000 forklifts.

Lu Daming, president of CITA, says both domestic and foreign forklift manufacturers focused on the Chinese market during the recession, resulting in fierce competition and falling profits.

Industry members contacted by

Forkliftaction.com News say the market is growing in 2010 but think it will be a while before it regains the zenith of 2008.

After the GFCLinde (China) Forklift Truck Corp was the first overseas forklift manufacturer to set up a plant in China. Now manufacturing over 200 different forklift types including internal combustion and electric forklifts, warehouse trucks and container handlers, Linde China's Xiamen plant produces materials handling equipment for both the domestic and international markets.

Linde China CEO Chingpong Quek |

CEO Chingpong Quek says the Chinese forklift market has been growing "strongly" in the past 12 months, "especially in the first quarter of 2010". However, he adds that the GFC has negatively affected Chinese forklift exports. "Therefore, most manufacturers focus their efforts in the domestic market."

Chinese forklift industry members estimate that about 80% of Chinese-produced forklifts are consumed by the domestic market, while 20% are exported. In the past 12 months, some industry sources say the volume of exported forklifts has halved.

Joy Lin from Tailift Co Ltd agrees there was a sharp drop in the Chinese market in October 2008, but says it has bounced back since March 2009. "It has been slowly increasing and has reached its peak in the first quarter of 2010."

Sang Tian, vice president of Hangzhou-based manufacturer EP Equipment, says her company has seen its highest demand for petrol-engine forklifts and manual handling equipment over the past 12 months. EP has sold 3,060 forklifts since the start of 2010.

But Sang says not all forklift companies are so lucky. "Some (Chinese manufacturers) came and went. [The] economy is one of the factors influencing the changes [and] some manufacturers have focused on sales and marketing at the expense of R&D, quality control and after-sales (service)."

Chinese Forklift Trends The Xilin AC electric explosion-proof forklift. |

Data from CITA shows that the ratio of internal combustion to electric forklifts sold in China has remained largely unchanged from 2004 to 2008. For every two electric forklifts sold each year, there are eight internal combustion forklifts sold. In 2008, about 22% of the forklifts sold were electric forklifts, compared to 20.4% in 2007; 21% in 2006; 20.5% in 2005; and 20.4% in 2004.

The number of warehouse forklifts sold increased rapidly in 2007 and 2008. In 2005, 5,938 warehouse forklifts were sold; in 2006, 8,588 units; in 2007, 16,156 units; and in 2008 this reached 24,958 units.

The trusty Chinese workhorse is still the diesel forklift, and counterbalance forklifts still greatly outnumber warehouse forklifts. This was the same situation when

Forkliftaction.com News reported extensively on the Chinese forklift market in 2006

(Forkliftaction.com News #256).

Barry Su, Zhejiang Maximal Forklift Co Ltd (Maximal)'s overseas department general manager says that the majority of forklifts made in China today are conventional counterbalance forklifts.

Interestingly, CITA president Lu said in his overview of the Chinese forklift market in Shanghai last year that post-GFC, the global economy "required a new growth point to provoke a new round of growth".

He explained that the green economy, starting with new energy and a low-carbon economy, is becoming a popular topic globally and predicted that China, compared to other developed countries, would have a greater market demand for environmentally friendly forklifts in the future.

Alex Wu, project manager of Wuxi Kipor Power Co Ltd (Kipor) claims that his company is the first Chinese forklift manufacturer to produce a diesel-electric hybrid forklift. It was launched at the end of 2008 and is now available globally.

"The old brand diesel forklifts are still the major products in China, with more emphasis on [improving] load capacities. However, long-sighted leaders always plan for the future. Our environment relies on our efforts and our company's goal is to save energy and reduce emissions," Wu says.

Kipor, established in 1998 in Wangzhuang Industry Area, Wuxi City, has sold 900 forklifts since the start of the year. It manufactures 1-5 tonne diesel internal combustion forklifts, 1-5 tonne AC electric forklifts and 1-5 tonne hybrid forklifts. Currently, 300 out of Kipor's 2,300 employees work in the R&D department. Wu says Kipor's turnover for 2008 totaled USD300 million.

Fierce CompetitionWhile not every local Chinese forklift manufacturer

Forkliftaction.com News contacted identified environmental issues as a priority, all agreed that there is intense competition among the forklift players.

Maximal's Su says that competition in the Chinese market is "getting more intensified and price-focused".

"More and more new enterprises have entered the market. To survive, they emphasise sales, causing a price war."

He stresses that his company's sales strategy does not include lowering forklift prices for the sake of grabbing market share.

"We insist on four points. [Firstly we] focus on brand establishment and setting a proper marketing concept. Next, we stick to a quality-first principle. Then, we enforce quality after-sales service. Finally, we set reasonable prices."

Su adds that Maximal is now promoting an online after-sales service and boasts it has established China's leading spare parts system, which he believes helps boost the Maximal image as a quality brand.

Tailift's Lin echoes Su's sentiments about brand improvement: "Improve service, improve after-sales service and spare parts, besides developing products to meet the user's specifications."

Tailift manufactures forklifts for the Chinese market and for the export market in Taiwan at its Qingdao plant and forklifts. It says it has sold about 5,000 forklifts this year.

Banyitong Science & Technology Developing Co Ltd export manager Lany Liu says her company's competitive strategy is to grow its market share through "high technology and quality products".

Liu explains that sales of Banyitong's MIMA Lift forklifts had decreased over the past 12 months, causing the company to cut costs, but it continued to invest in developing new products to prepare for a market recovery.

"Now that we have introduced narrow-aisle trucks, our valued customers are increasing their purchases as well," Liu says.

Hefei-based Banyitong has sold 500 forklifts since the start of 2010. Its product range includes reach trucks, stackers, electric pallet trucks, tow tractors, order pickers, automated guided vehicles and electric counterbalance forklifts.

The escalating price of raw materials is also putting pressure on manufacturers, Kipor's Wu says.

"Many forklift companies have started to jerry-build due to the higher price of raw materials. We'd rather put more money in manufacturing than jerry-build. We believe that this will pay off in the near future as the Kipor brand remains known for quality," he explains.

Chinese forklift manufacturers today not only realise the importance of product quality for their domestic customers but are increasingly aware of their overseas clients' requirements.

Wu believes that Western customers are most concerned about the service offered by forklift suppliers.

"Today, most manufacturers' strategy is to enter the Western market with lower price and then expand market share. I don't agree with it. A 'zero-profit' industry will not last long."

He suggests that manufacturers focus on improving their brand values by improving product quality. "Price competition will not benefit the health of the entire industry."

Angela Gong, sales manager for Hangzhou Zheli Forklift Group Co Ltd, says forklift design and technology, marketing strategy and after-sales service are the key ingredients to Chinese forklifts succeeding in Western markets.

The manufacturer's UN forklift brand stands for "Universal", which Gong says signifies the future development of the company. Currently, Hangzhou Zheli produces the U-series range of 1-10 tonne internal combustion and 1-3.5 tonne electric forklifts, and warehouse equipment, which are available in China and most European countries.

Ningbo Ruyi president Chu Jiang |

Ningbo Ruyi Joint Stock Co Ltd president Chu Jiang admits that while the past 12 months have been tough going for his company, he sees strong market improvement this year. Hangzhou-based Ningbo Ruyi has sold 3,000 forklifts this year.

"Our brand is our advantage. Ningbo Ruyi's Xilin brand is famous in China. We compete with other brands in brand name, quality, after-sales and pricing," Chu says.

Ningbo Ruyi employs about 1,580 people and has 89,000 sqms (957,988 sqft) of plant area. It produces electric and internal combustion forklifts, reach trucks, LPG dual fuel forklifts and claims to be the only one in China manufacturing AC electric explosion-proof forklifts. Its website claims it has been the leading pallet truck exporter in China since 1989.

Hytsu Group CEO Jerry Hu thinks that Chinese manufacturers need to prioritise stocking machines and parts at local warehouses and partnering with local, reputable vendors to provide after-sales service.

"Our products are on par (quality-wise) with Japanese and German forklifts, but (offer) more added value in service and price," Hu boasts.

The Hytsu Group produces 1-3.5 tonne electric forklifts and 1-10 tonne internal combustion forklifts, of which 95% are exported. This year it has sold 1,178 forklifts.

What's in the future?Maximal's Su says while China's forklift market has picked up recently, he expects the market to gradually cool down in the next 12 months, due to the Chinese government's macro-economic control measures.

He is also confident about the export market in the next 12 months.

Hytsu's Hu thinks that the higher price of raw materials and inflation will pose challenges for Chinese manufacturers in the export market.

Linde China's Quek foresees strong growth in food and beverage, logistics, retail and railway industries while Ningbo Ruyi's Chu predicts growth in docks, ports and logistics centres.

To move forward, Chinese forklift manufacturers must invest in R&D despite the movements in the economy. EP's Sang Tian's musings undoubtedly reflect the sentiments of Chinese manufacturers who wish to excel in the global marketplace: "As a Chinese manufacturer, we have to pay extra attention to R&D because we believe the copy period is gone. If we do not have our own ideas, we will never have the chance to be the world's leading manufacturers and can never get rid of a low-price, low-quality image... We should look forward and welcome challenges."