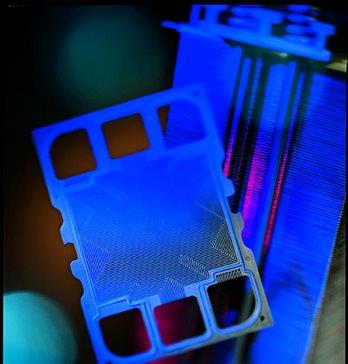

Fuel cells convert hydrogen fuel into power through an electrochemical reaction. |

Technology firm Plug Power Inc reports shipment of 246 hydrogen-powered fuel cells during the second quarter ended 30 June, down from 388 in the comparable year-earlier period.

Plug Power says it received new orders valued at USD7.5 million during the quarter. Of the total, orders worth USD6.1 million arrived between the

May announcement of a major strategic investment and 30 June. Plug Power says the investment spurred customer interest.

Paris-based industrial gas supplier L'Air Liquide SA said 8 May it is making a USD6.5 million investment in Plug Power. Earlier, amid financial pressures, Plug Power was contemplating a possible sale of the company.

Plug Power says a unit of Daimler AG's Mercedes-Benz division plans to add 123 GenDrive fuel cell units to its fleet in Huntsville, Alabama, to support a new logistics centre next to its manufacturing facilities. Plug Power believes the order rate "puts the company on the pace it needs to meet its stated goal of being profitable on an earnings before interest, taxes, depreciation, amortisation and stock-based compensation basis by mid 2014."

Other shipments during the quarter involve expansions to existing BMW sites and converting forklift trucks at P&G's Mehoopany, Pennsylvania, site from lead-acid battery to GenDrive fuel cells. A Riverside, California, facility of Sysco is among the first Plug Power customers to use an onsite reformer to convert natural gas to hydrogen.

Latham-based publicly traded Plug Power reports a loss of USD6.62 million on revenue of USD7.50 million for the second quarter.

"What is most encouraging about this quarter's sales is realising the business coming from long-time customers who are growing their fleets in existing installations and expanding to new facilities," Andrew Marsh, Plug Power chief executive officer, says. "From an execution perspective, I'm pleased with the progress we're making towards meeting the targets we've set for revenue and for managing our operational costs."