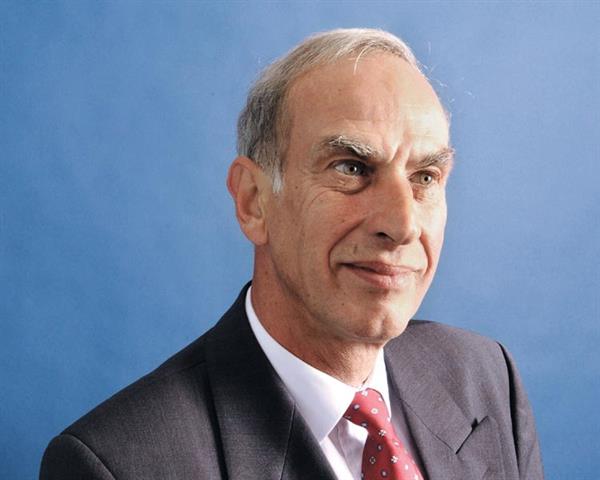

BOC chairman Rob Margetts |

BOC management repeated its reservations about Linde's offer to buy the British gas group at a shareholders' meeting last Friday (

Forkliftaction.com News #244).

BOC chairman Rob Margetts said the takeover could paralyse BOC for months and did not reflect the group's growth potential.

Margetts referred to the 10-month period of uncertainty that followed BOC agreeing to a preconditional offer from Air Products and Air Liquide six years ago. The offer failed to get regulatory clearance.

"Whether or not the issues are less in the case of Linde does not hide the fact that regulatory clearance was a precondition. The unsolicited approach from Linde also contained regulatory hurdles as a precondition, which meant your company would inevitably have to suffer a further period of uncertainty while these were being examined," he told shareholders.

"These preconditions were onerous enough but also the proposal failed to take account of the growth prospects for your company."

German newspaper

Handelsblatt reported that institutional BOC shareholders who wanted management to negotiate with Linde believed a higher offer was possible.

Financial sources believe Linde has enough room to manoeuvre to increase its offer from GBP15 (USD26.70) a share to GBP16 (USD28.45) a share, the report said.

Linde spokesperson Uwe Wolfinger would not comment on speculation the group would sell its forklift business to finance a possible acquisition of BOC.