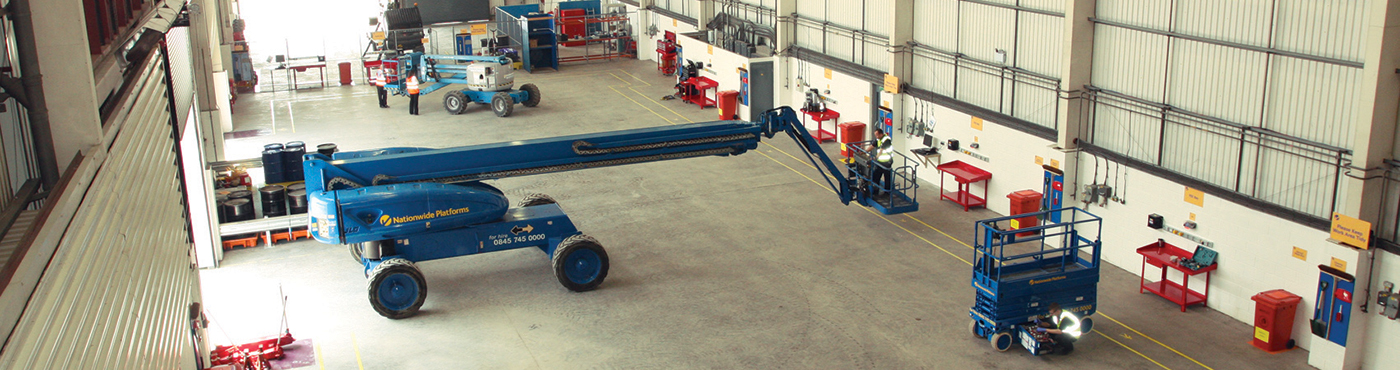

Lavendon is a market leader in the rental of powered access equipment. |

By Luc de SmetBelgian TVH and French Loxam are locked in a bidding battle over British Lavendon, a renter of cherry picker equipment with a turnover of some EUR290 million (USD311 million).

The contest began in November, 2016 and the last TVH offer of EUR524 million (USD562 million) was followed last week by a fourth counter-offer by Loxam, valuing Lavendon at EUR706 million (USD757 million). To get back into the running, TVH would have to offer at least 4% more - around 37% more than its November offer.

Lavendon has made it clear that it prefers a takeover by Loxam. Loxam has reached agreement with M&G Investment Management, Lavendon's largest shareholder, to acquire its 18.6% stake, while TVH already has an estimated 20% of Lavendon shares.

"Currently, our total rental fleet numbers nearly 25,000 machines," says Dominiek Valcke, CEO of TVH. "Adding Lavendon would lift that to nearly 47,000 units."

"The most important added value is that we would cover a larger market. Lavendon is (the) market leader in the UK and the Middle East.

"Future (prospects) for the rental market are positive. It is a growing market. That is why we are interested in Lavendon."

A possible acquisition would lift TVH's turnover by about a quarter to almost EUR1.5 billion (USD1.61 billion).

Lavendon is a client of TVH for spare parts.

This is the third time that TVH has moved on Lavendon. Earlier attempts in 2010 and 2011 failed.