The August Logistics Manager's Index Report remains stable

The August Logistics Manager's Index Report remains stableThe August Logistics Manager’s Index Report (LMI) has increased marginally to sit at 59.3, an increase of 0.1 basis points from the July index, representing a “moderate rate of expansion” in the United States’ logistics industry.

Any reading above 50.0 indicates that logistics is expanding; a reading below 50.0 is indicative of a shrinking logistics industry.

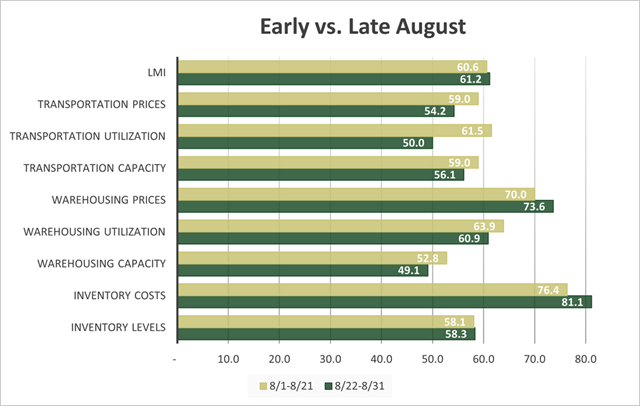

The August LMI reveals growth in inventory level expansion (up 2.7 month-on-month) to 58.2; inventory costs (increased by 7.3 m-o-m) 79.2 and warehousing prices (up 3.9) 72.2.

Capacity expansion is slowing to sit at 50.5 in August, down 0.6 points m-o-m.

Other notable drops were evident in transportation prices, down 6.9 to 56.1 and transport utilisation which sat at 54.7, down 4.8 points m-o-m.

The August LMI is steady

The August LMI is steady

The LMI is produced by researchers at Arizona State University, Colorado State University, Florida Atlantic University, Rutgers University, and the University of Nevada, Reno in conjunction with the Council of Supply Chain Management Professionals (CSCMP) using responses from supply chain professionals.

“Continuing the trend we have observed over the last four months, logistics expansion is being disproportionately driven by smaller firms, who reported an overall index of 62.7, which is statistically significantly higher than the 58.2 that was reported by our larger respondents,” the LMI report states.

“This continued disparity is largely driven by higher inventories and tighter capacity for smaller firms.

“Interestingly however, the gulf that had existed between Upstream firms (60.1) and Downstream firms (62.7) in the overall index has disappeared, suggesting that more of the inventories that were built up in the first half of the year have begun matriculating down to the retail level in earnest.”

The report warns the slowdown in output of Chinese factories is a “potential signal that imports will slow down through the rest of the year”.

A slowdown for the US logistics sector and supply chain for the remainder of 2025 has now been forecast by the report.