ISM capital expenditure analysis |

Economic growth in the United States will continue in 2020, according to purchasing and supply management executives surveyed by the Institute of Supply Management (ISM). Expectations are for a continuation of the growth that began in mid-2009, as indicated in the monthly

ISM Report On Business.

The manufacturing sector is optimistic about growth in 2020, with revenues expected to increase in all 18 manufacturing industries, and the non-manufacturing sector also indicates that 17 of its industries will see higher revenues.

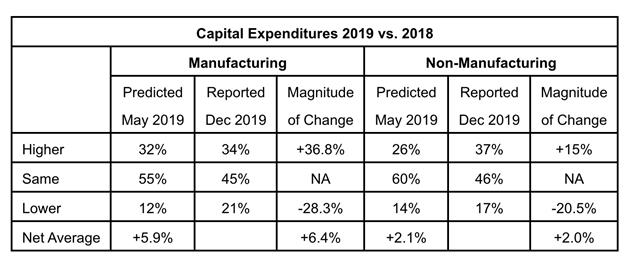

Capital expenditures are expected to decrease by 2.1% in the manufacturing sector (after 6.4% growth in 2019) and increase by 3.4% in the non-manufacturing sector. Manufacturing expects that its employment base will grow slightly, by 0.1%, while the outlook for the next 12 months is predominately growth oriented.

These projections are part of the forecast issued by the Business Survey Committee of the Institute for Supply Management.

According to the report, manufacturing purchasing and supply executives are optimistic about their overall business prospects for the first half of 2020, with business continuing to expand through the second half of 2020. Manufacturing experienced eight consecutive months of growth from December 2018 to July 2019. However, manufacturing contracted during the period from August 2019 to November 2019. This resulted in an average PMI of 51.8%, as compared to 59.2% for the 12 months ending November 2018. Respondents expect raw materials pricing pressures in 2020 to increase but expect profit margins to improve in 2020 over 2019. Manufacturers are also predicting growth in both exports and imports in 2020.

In the manufacturing sector, respondents report operating at 83.7% of their normal capacity, down 0.5% from the 84.2% reported in May 2019. Purchasing and supply executives predict that capital expenditures will decrease by 2.1% in 2020 over 2019, compared to the 6.4% increase reported for 2019 over 2018. Manufacturers expect employment in the sector to grow by 0.1% in 2020 relative to December 2019 levels, while labour and benefit costs are expected to increase an average of 0.7% in 2020. Respondents also expect the U.S. dollar to strengthen against all seven currencies of major trading partners in 2020, as was the case in 2019.

The panel predicts the prices paid for raw materials will increase by 0.4% during the first five months of 2020, with an overall increase of 1.1% for 2020. This compares to a reported 0.7% increase in raw materials prices for 2019 compared with 2018.

Half of non-manufacturing supply management executives (including transportation and warehousing management) expect their 2020 revenues to be greater than in 2019. They expect a 3.4% net increase in overall revenues for 2020, compared to a 4.4% increase reported for 2019 over 2018 revenues.

Non-manufacturing supply managers report operating at 86% of their normal capacity, lower than the 89% reported in May 2019. They are optimistic about continued growth in the first half of 2020 compared to the second half of 2019, with a projected decrease in growth rate for capital reinvestment. They forecast that their capacity to produce products and provide services will rise by 3.6% during 2020, and capital expenditures will increase by 1.3% from 2019 levels. Non-manufacturers also predict their employment will increase by 1.2% during 2020.