Mobile elevating work platform (MEWP) rental markets have continued to recover strongly after the pandemic in 2021 and 2022, despite clouds on the horizon caused by global uncertainty around geo-political upheavals and increased input costs, driven by rising inflation and the war in Ukraine, according to the latest analysis conducted for the International Powered Access Federation (IPAF) by Ducker.

Most markets in Europe, the US and the Middle East continued to recover strongly, although a resurgence of COVID-19 and accompanying lockdowns and restrictions in some parts of China did hamper the recovery there, as well as causing knock-on effects in the supply of Chinese-manufactured MEWPs that were increasingly sought-after during 2021, owing to supply-chain issues affecting many western manufacturers.

The newly published Global Powered Access Rental Market Report 2022 indicates that, after a relatively cautious start to the year in which many countries were still dealing with second and third waves of the COVID-19 virus, most MEWP rental companies sought to increase rental fleet size and utilisation rates during 2021; post-pandemic recovery was fairly even worldwide and maintained a steady rate.

Companies returned to planned investment strategies and supply struggled to keep up with demand in terms of new machines, especially specialist and all-electric MEWPs, owing mainly to the “whiplash” effect of the pandemic recovery on fuel prices, energy costs and raw materials. This led to longer lead times on machines and an increased reliance on older or second-hand machines to maintain fleets in line with demand.

This effect can be seen to have continued in the first half of 2022, driven by rising global energy costs, soaring inflation in most developed economies, and exacerbated by the knock-on effects of Russia’s invasion of neighbouring Ukraine in February 2022.

Overall, the report indicates that the European MEWP rental market partially recovered from the pandemic in 2021, and overall showed revenue growth of 7% across 2021. Europe’s rental market reached EUR3 billion (USD3.05 billion) total revenue, to almost regain pre-pandemic levels of activity owing to recovering demand in both construction and non-construction sectors. The European fleet stood at approximately 325,000 units at the end of 2021.

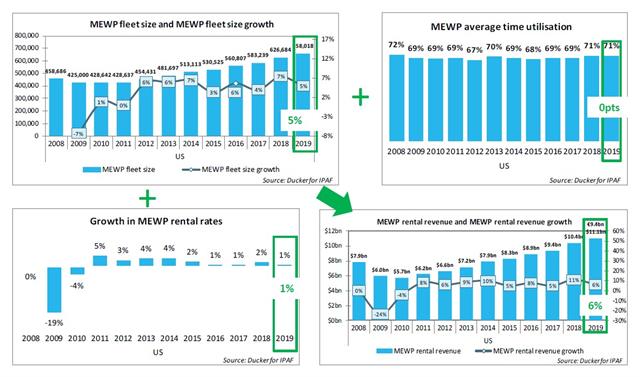

In the US, MEWP rental revenue increased by 15% across 2021 to surpass pre-pandemic levels, owing to rapid reopening of non-construction business and pent-up demand from construction projects paused during 2020. With President Joe Biden being inaugurated in early 2021, the vaccine roll-out and post-pandemic recovery stimulus were instrumental in rebuilding confidence and rebounding activity in the US.

As well as revenue growth (driven in part by increased rental rates and rising demand for MEWPs), MEWP fleet size in the US grew by 10% in 2021, as rental companies resumed their pre-pandemic investment strategies and attempted to prevent utilisation rates from increasing extensively.

Overall, US fleet growth was hampered by supply chain disruptions, as in other western markets, though the US as a whole was able to increase fleet size by more than 60,000 units, to stand at 722,105 by the end of 2021. This growth is forecast to continue in 2022 but may be inhibited by inflationary pressures on the economy and trade issues, including a prohibitive tariff ruling on Chinese MEWP imports announced in 2021.

The China MEWP rental market is still growing at unprecedented speed, despite the pandemic: rental market growth remained strong (47%) in 2021, driven mainly by fleet expansion. However, uncertainty around continued outbreaks in key cities in China limited market optimism, with forecast annual revenue growth of 10% in 2022, and 6% in 2023.

The total fleet size continued expanding at a remarkable rate in China, reaching almost 330,000 units in 2021. Total fleet size is forecast to stand around 435,000 to 440,000 at the end of 2022.

Analysts conclude that fleet sizes and rental revenue are increasing in all markets, investment confidence has returned, the pivot towards electric-powered machines continues apace and even well-documented supply-chain issues cannot dampen optimism. While there are clouds of uncertainty on the horizon, the outlook remains bright for the global powered access rental industry for the foreseeable future.