Hyster-Yale Materials Handling has announced consolidated revenues of USD895.4 million, an operating loss of USD15.7 million and a net loss of USD19.4 million for the second quarter of 2022. Compared to 2021, revenues increased 17.0% and shipments rose 11.5%.

The company notes that the global forklift market grew in the first quarter of 2022, but appeared to decline significantly in the second quarter compared to the high levels of both the second quarter of 2021 and first quarter of 2022.

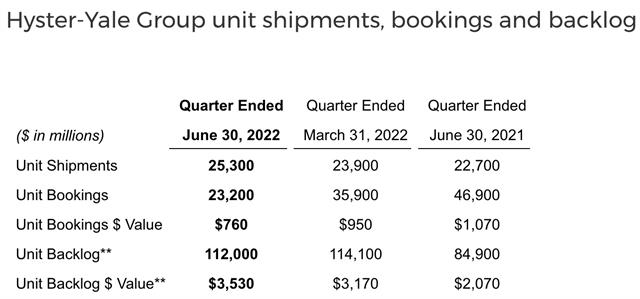

“As a result of the market decline, as well as the company's focus on accepting only orders with expected sound margins and in the context of long lead times in a still very large market, bookings in the second quarter of 2022 decreased substantially from the robust levels of the 2022 first quarter and 2021 second quarter,” directors explain.

“The company is focused on pricing new bookings close to target margins based on anticipated costs at the time of expected production.”

The results analysis points out that second-quarter unit shipments increased compared with the prior-year second quarter and the 2022 first quarter due to increased production rates from prior year levels, facilitated by a moderately reduced impact of component shortages from the ongoing global supply chain and logistics constraints. “However, current supply chain constraints of certain critical components continued to negatively affect second-quarter 2022 production rates. Nevertheless, with higher shipments and lower bookings than in the 2022 first quarter, the company's high backlog level with its associated less than fully competitive lead times, began to decrease in the second quarter of 2022 for the first time since the beginning of the pandemic.”

Hyster Yale notes an operating loss of USD11.7 million in the second quarter of 2022 for its

Lift Truck business, pointing to losses in the EMEA region, as well as higher operating expenses in the Americas.

The lower European results were primarily due to higher material and freight costs, unfavourable currency movements and higher manufacturing costs.

Over the remainder of 2022, the company expects the global market to continue to decline from the historical highs of 2021, but remain above pre-pandemic levels. “As a result of this market outlook and the company accepting only orders with expected sound margins, the Lift Truck business is anticipating a substantial decrease in bookings during the second half of 2022 compared with the second half of 2021, particularly in the Americas,” the report notes.

“Given the continued component shortages due to supply chain constraints and the consequent reduction in production plans, significant material and freight cost inflation, and, more recently, the impact of the COVID-19 lockdowns in China and the Russia/Ukraine conflict, as well as continued losses at Nuvera, the company, on a consolidated basis, expects a larger net loss in the third quarter of 2022 than previously projected, but a return to net income in the fourth quarter of 2022,” directors conclude.