Linde Material Handling is being primed for a possible sale as parent company Linde AG, of Wiesbaden, Germany, this week announced that its profitable forklift segment was breaking away to become an independent legal entity. From August 1, the new entity will be known as Linde Material Handling GmbH & Co KG.

Forkliftaction.com News reporter

Christine Liew chronicles the rise of the company that overtook Balkancar in 1990 to hold top position in the world forklift company rankings for more than a decade.

The ExportweltmeisterGermany is renowned for cars and high precision technology. A

Financial Times article on May 19, by Bertrand Benoit and Richard Milne, described Germany as the "exportweltmeister", or export world champion, since it edged out the US as the world's biggest exporter in 2003. In 2005, only 23 per cent of materials handling giant Linde's forklift sales were in Germany, 70 per cent of long load handling specialist Hubtex Maschinenbau GmbH's products were exported and leading warehouse equipment supplier Jungheinrich AG's foreign sales comprised 72.3 per cent of its 2003 group sales.

European Federation of Materials Handling's (FEM) industrial truck division president and head of France-based Manitou BF, Marcel Claude Braud, would not comment on Germany's share of the world forklift market but FEM statistics show Europe had 42 per cent of the world market in 2004.

Leading German manufacturers declined to comment on market shares of the main German forklift players. A European source said it "seems the shares of brands in Germany are a big secret". However, a former Jungheinrich senior executive in North America estimated the top six manufacturers in Germany to be Linde (30 per cent), Jungheinrich (28 per cent), Still (14 per cent), Hyster (8 per cent) BT (7 per cent) and Toyota (7 per cent). German logistics magazine

dhf intralogistik put Linde's forklift sales for 2004 at EUR3,239 million (USD4,108 million) and nearest German competitor Jungheinrich's forklift sales at EUR1,406 million (USD1,783 million).

Linde Material Handling: Breaking away Dhf intralogistik magazine, the pioneer of Germany's world ranking list of forklift manufacturers, has ranked Linde as number one for more than 10 years. Editor Wolfgang Degenhard said that, after the fall of Balkancar, Linde was number one on the list from 1990 but, in 2002, Toyota overtook the German manufacturer. Toyota's 2002 forklift sales totalled EUR2,927 million (USD3,713 million) while Linde made sales of EUR2,861 million (USD3,629 million).

Linde Material Handling managing director Georg Silbermann expected to retain his position. |

Harald Wozniak, Linde Material Handling head of international marketing, said "nothing much" would change with the separation of Linde Material Handling from parent company Linde AG, of Wiesbaden, Germany. Current materials handling divisional board members for the Linde, Still and OM brands would retain their positions, he said.

The Linde group has changed significantly since its birth in the late 19th century. Established in the 1870s as a refrigeration business by Technical University of Munich professor Carl von Linde, the company later diversified into gas production and materials handling. The refrigeration business was sold in 2004 to Connecticut, US-based Carrier Corp for EUR325 million (USD412 million).

The first whispers of a possible merger with British gas giant BOC Group plc began at the end of 2004 and continued in 2005. In June 2005, Linde told German newspaper

Handelsblatt there were no merger talks with BOC. But German and international media continued speculating until Linde's announcement in January 2006 that it had offered GBP15 (USD27.84) a share for BOC.

From next week, Linde Material Handling will be an independent legal entity. The US Federal Trade Commission cleared Linde AG's proposed acquisition of BOC last week and the European Commission gave its approval last month. Linde will focus on expanding the gas business once the BOC merger is finalised in the third quarter of 2006.

The Linde name will carry Linde Material Handling as it establishes itself in newer international Linde markets, like Asia and the US, and gains new market share in its stronghold Europe. Last year Linde Material Handling was recognised as best brand in the forklift category after 10,000 readers voted in a survey conducted by a Stuttgart publishing group. The same year, a market research institute surveyed 300 logistics managers in Germany and declared Linde Material Handling winner in the 2005 image rankings of German trade journal

Logistik Inside. Respondents said Linde had the best reputation among 99 selected logistics products suppliers.

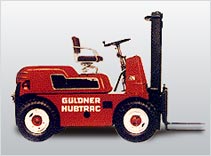

The Long Road here: 1955-2006Linde Material Handling, of Aschaffenburg, traces its success as a forklift manufacturer to a 1955 invention, the hydrocar. Güldner-Motoren-Werke, a Linde company and tractor manufacturer, produced a utility truck that became the world's first production model equipped with a hydrostatic drive. The hydrocar was used as a nimble transporter in airports, railway stations, and industrial shops and in the farming and forestry industries.

The vehicle had no clutch, gearbox or footbrake. Fitted with a single steering and driving lever, hydraulic fluid enabled infinitely variable acceleration and steering control for the vehicle, the Linde website said.

The first Linde forklift. |

In 1957, Linde produced its first forklift, a hydrostatic drive forklift named hubtrac. It was showcased at the Hannover fair (CeMAT is the successor fair) in 1959. Today, all Linde internal combustion forklifts up to 18 ton capacity have hydrostatic drive technology.

In 1969, Linde focused on its forklift line, producing hydraulic products used in construction, agriculture, forestry and shipbuilding and materials handling equipment. The German company tapped into the US market in 1977 by buying Baker. Linde forklifts were initially marketed in the US under the Baker name. US chemical company Union Carbide had held US rights to the Linde brand for 80 years but that changed in 1999 when Linde bought the rights.

A key event occurred in 1985 when Linde bought France's largest forklift producer, Fenwick. The previous year, Linde had produced 19,508 forklifts. Fewer than one third were warehouse forklifts. The Fenwick acquisition helped complete the Linde product range with warehouse equipment. In 2005, Linde produced 71,866 forklifts and almost half were warehouse trucks (33,137 warehouse trucks, 14,125 electric forklifts and 24,604 IC forklifts).

In 1985, Linde launched the 351 series forklift, which it claimed was one of the "world's most successful forklifts".

"The 351 was the first forklift with a really outstanding look, designed by Porsche Design. At the time, it set benchmarks in ergonomics, safety, reliability and performance," Wozniak said.

In 1989, Linde purchased British forklift maker Lansing-Bagnall to complete its international presence with Lansing's global sales and service network.

In 1993, Linde was the first foreign manufacturer to build a forklift plant in China. Xiamen-based Linde (China) Forklift Truck Corp, established with an initial investment of RMB1.7 billion (USD213 million), now has 1,400 employees in 35 branches.

Linde created a prototype fuel cell forklift as part of a demonstration project with Siemens in 2001. The study was deemed a success but, because there was no real demand for a fuel cell forklift series, Linde did not develop the project further.

The same year, the 100,000th unit of the Porsche Design 351 series was produced. Linde claimed the series had been Europe's most built forklift. A new factory for heavy trucks and container handlers was unveiled in Methyr Tydfil, Wales, in 2001. The old plant was in Blackwood, UK.

From 1994 to 2001, Linde's forklift production had been on a sharp increase. That changed in 2002 when a weak forklift market saw sales and earnings drop. After forklift production peaked at 63,214 units in 2001, production dropped below 60,000 in 2002. During the first half of 2002, Linde's forklift orders dropped 5.8 per cent from EUR1.628 billion (USD2.065 billion) in the 2001 corresponding period to EUR1.534 billion (USD1.946 billion).

The company said it was counting on a new forklift series, the Aschaffenburg-manufactured 39X, launched at CeMAT 2002, to see orders grow in the second half of 2002. At the end of 2002, group sales for the year had dropped slightly from 2002 (EUR8.833 billion to EUR8.276 billion/ USD11.205 billion to USD10.499 billion) and the materials handling business's earnings dropped "significantly". Demand for Linde forklifts in Asia grew by double-digits but European and American demand dropped nearly 10 per cent. Linde blamed decreasing demand and intense competition for the drop in sales.

Linde launched a cost savings program, TRIM, at the end of 2002, to save EUR100 million (USD126.9 million) in 2003 and 2004 through departmental reorganisation. It shed 500 jobs and increased use of Linde-made components.

A worldwide recovery in the forklift market saw Linde report a 10.1 per cent increase in sales to EUR3.372 billion (USD4.277 billion) for financial year 2004. Linde CEO Wolfgang Reitzle attributed the improvement to TRIM.

To further increase profits, the company brokered new worker agreements with Linde and Still employees in 2005. In exchange for a conditional six-year promise that production would not move to Eastern Europe, workers accepted lower salaries and longer work hours. The agreements were expected to result in "tens of millions of euros in annual profits", the company said.

An illustration of Linde's newest electric counterbalance forklift, the E12-E20 range (386 series). |

Linde's latest products include the Basingstoke, UK-manufactured X-range reach trucks, which have the battery positioned under the operator's seat. The R14X-R17X reach trucks have load capacities from 1.4 tons to 1.7 tons and a lift height of up to 9.6 metres. The new 386 electric forklift series, with what Linde claims is "a completely new energy management system", rolled off the Aschaffenburg plant in June and will be marketed in Germany by the end of 2006.

The strategy of a forklift giantLinde Material Handling said in its 2005 annual report its goal was to strengthen the brand name globally by taking into account regional requirements and opportunities. In the USA and Asia, Linde's market shares are below five per cent. The bulk of Linde's forklift sales - more than 80 per cent - come from Europe.

In 2005, 23 per cent of Linde's forklift sales came from Germany, 61 per cent from Europe, 4.5 per cent from Asia, 3.9 per cent from North America, 3.1 per cent from Australia/Africa and 1.5 per cent from South America.

Linde has said it aims to achieve a 15 per cent market share in China by 2008. The size of the Chinese market for premium quality forklifts, like Linde's, is about 14,000 units and expected to grow 15 per cent in the next few years. The US market is estimated at 200,000 units this year and Linde wants a double-digit market share in US in three to five years.

Through its acquisitions, Linde now boasts a complete line of forklifts: front stackers, sideloaders, container handlers, retractable mast stackers, high-shelf stackers, vertical and horizontal order pickers, high and low-level lift trucks, tow tractors and platform trucks, automated transport systems and explosion-proof forklifts.

Its plants are in Aschaffenburg, Aschaffenburg-Nilkheim, Weilbach and Kahl/Main, Germany; Cenon-sur-Vienne, France; Basingstoke and Merthyr Tydfil, UK; and Xiamen, China. Forklifts designed to meet US market specifications are produced at Summerville, South Carolina, USA.

Linde's competitors hail the company's quality product for its success. But Linde credits its decentralised organisational structure as a major factor. Although headquartered in Germany, the company has divisions and manufacturing companies in Aschaffenburg, Germany, France (Fenwick-Linde), the UK (two Lansing Linde companies), China (Linde-Xiamen) and the USA (Linde Lift Truck). The manufacturing companies are responsible for marketing the forklifts they produce.

Sales and after-sales service are overseen by Linde's direct sales companies, aided by Linde's exclusive franchise network. Overseas sales companies are located in Austria, Australia, Switzerland, Spain, the UK, Italy, the USA, Singapore, Hong Kong, South Africa, Japan, Hungary, Sweden, Chile, Lebanon, Brazil, Croatia and Slovenia. Since establishing its presence in China in 1993, Linde now has 1,400 employees working in 35 branches covering more than 220,000 square metres in facilities.

Linde's acquisitions were key to the company spreading its international presence. Buying Lansing-Bagnall in 1989 gave Linde the benefit of Lansing's existing sales and service network. Lansing's manufacturing, sales and marketing operations, at Basingstoke and Merthyr Tydfil, south Wales, and eight network companies comprising 25 customer support centres, consolidated under the Linde name when Lansing Linde Ltd changed its name to Linde Material Handling (UK) Ltd in 2003.

In 2001, Linde acquired a majority shareholding in Brazilian warehouse equipment maker Ameise Comérico e Indústria SA. The purchase was part of Linde's strategy to extend its market position in South America and enabled the company to sell its counterbalance trucks through Ameise's service and distribution network.

"We call it maintaining closeness to customers," Linde says on its corporate website of its on-site presence through direct sales companies globally.

"Active communication between member companies and fast response to regional market trends are key elements in the division's ongoing business success."

For fiscal 2005, Linde Material Handling's sales increased 7.6 per cent to EUR3.628 billion (USD4.602 billion) or 38.1 per cent of the group's total sales. Operating profit increased 14.9 per cent to EUR223 million (USD283 million).

Linde purchased Hamburg-based forklift manufacturer Still in 1973 and Italian manufacturer OM Carrelli Elevatori Spa in 1992. Linde has a joint venture with Komatsu Forklifts, Japan. A Linde Material Handling spokesperson declined to comment on synergies between the three brands or the Komatsu partnership.

Other German forklift industry players:Jungheinrich AGEstablished in 1953, Jungheinrich AG of Hamburg, Germany, has been ranked the world's third forklift manufacturer by

dhf intralogistik for financial year 2004. Jungheinrich's forklift sales in 2004 totalled EUR1,406 million (USD1,783 million). The company manufactures forklifts from its Norderstedt, Moosburg and Lϋnegurg plants in Germany. In 2004, the company employed 9,000, half of which worked in its sales and service companies in 29 countries. Its direct sales network comprises 18 German sites.

Still GmbHStill GmbH was founded in 1920 by Hans Still in Hamburg, Germany. A supplier of forklifts, platform trucks, tractors and warehouse handling equipment, it has more than 6,000 employees. Its plants are located in Hamburg and Reutlingen, Germany; Montataire, France; and Rio de Janeiro, Brazil. Linde AG acquired the company in 1973.

Sichelschmidt GmbHA specialised manufacturer of explosion-proof forklifts, Sichelschmidt GmbH, headquartered in Wetter, Germany, was founded in 1914. The company recently closed its German plant and its new plants are near Vienna, Austria; and Waalwijk, the Netherlands. Marketing and sales for non-European markets are supervised by the US company Servolift LLC. It is also supported by sales offices in South Africa, South East Asia and the Middle East,

Hubtex Maschinenbau GmbHHubtex Maschinenbau GmbH, established in 1981, employs 200 and produces sideloaders and specialised forklifts with load capacities up to 80 tons. Its headquarters and plant in Fulda has around 220 employees. Turnover for Hubtex and its subsidiaries totalled nearly EUR80 million (USD101.5 million) in 2005. About 70 per cent of its products are exported. It has four sales and service branches in Stuttgart, Hamburg, Fulda and Dortmund Germany and subsidiaries in 29 countries.

Miag Fahrzeugbau GmbHBased in Braunschweig, Miag Fahrzeugbau GmbH, was founded as an independent company in 1983 to continue the activities of the former Bühler-Miag GmbH. Its product range includes pedestrian and platform trucks, tow trucks and custom-made trucks. The company has been developing industrial forklifts for the German and overseas markets for 70 years. It has 60 years' experience as an explosion-proof equipment specialist.

Genkinger-Hubtex GmbHGenkinger-Hubtex GmbH, located in Münsingen, which is in the middle of the Swabian Mountains, was established as Genkinger in 1922 by Hermann Genkinger. Genkinger produced special pumps and car jacks. In 1996, the company merged with Hubtex Maschinenbau GmbH and is now a Hubtex subsidiary. The company manufactures warehouse forklifts like pallet trucks, pallet stackers, order pickers and stackers. It started more than 80 years ago building trucks for the automobile industry. Today it makes transport and handling equipment for the textile industry, forklifts and customised solutions for customers' special needs.

Dambach Lagersysteme GmbH & Co KGDambach-Werke GmbH was established in 1925 as an advertising and road sign, enamel and machine manufacturer. Its subsidiary Dambach Lagersysteme GmbH & Co KG was set up in 1974 as Dambach-Industrieanlagen GmbH. Dambach Lagersysteme manufactures stacker cranes, multidirectional sideloaders up to 6 tonnes and the Hi-Lifter, a man-up stacker crane with a telescopic fork system with a lift height of 17 metres.

Hermann Paus Maschinenfabrik GmbHEstablished in 1968 as a wheel loader manufacturer by Hermann Paus, family-owned Hermann Paus Maschinenfabrik GmbH, headquartered at Emsbüren, Germany, started manufacturing compact large-capacity forklifts from 12 tons to 35 tons in 1982. Its customers are in the steel and paper industries. Their machines are customised according to clients' requirements. Half their forklifts are exported. It also manufactures construction and mining machines, hoists and aerial work platforms. In 2002, Hermann's sons Franz-Josef and Wolfgang took over the business as managing directors.

Xelan GmbHXelan in Harsewinkel, Germany, manufactures sideloaders, all-terrain forklifts with load capacities up to 50 tons and four-directional forklifts. It also custom-makes special handling machines with load capacities up to 65 tonnes, including telescopic forklifts for the mining and recycling industries.

Rudolf Maxein Fahrzeug-und Maschinenbau GmbHBased in Neuwied, Germany, Rudolf Maxein Fahrzeug-und Maschinenbau GmbH, has manufactured forklifts for more than 50 years, focusing on compact forklifts and custom-made forklifts with load capacities between six and 80 tons. Its forklifts marketed under the RMF brand are supplied to the local and international steel, aluminium and paper industries.

Honisch GmbHHonisch GmbH of Düsseldorf, Germany, has 33 years experience as a manufacturer of drum handling equipment. It produces forklift attachments for drum handling and is an expert on equipment used in hazardous areas and its products meet European safety laws. The company supplies its 180 degree "Panorama-view" mirror to original equipment manufacturers.

Kaup GmbHKaup GmbH's history began in 1894 when founder Peter Kaup started a village blacksmith's shop in Leider, close to the city of Aschaffenburg, Germany. The Aschaffenburg-headquartered company started specialising in forklift attachment manufacturing in 1962. Today, production is mainly centred at the main Kaup plant in Aschaffenburg, which employs around 500 people. The Asian region is served by a factory opened in Xiamen, China, in 1997.

Durwen Maschinenbau GmbHFounded in 1947 by Nikolaus Durwen, the family-owned company started producing forklift attachments in Plaidt, Germany, in 1970. The company started exporting its standard product range in the 1990s. Today, it has a wide product range that includes multi-fork positioners, clamps, sideshifters, load extending attachments, rotators, buckets and crane jibs.

Hans H Meyer GmbHHans H Meyer GmbH was established in Salzgitter, Germany, in 1953. The company manufactures attachments for forklifts from one to 10 ton capacities. It has around 220 employees. Hans H Meyer considers itself in the top four of the world's forklift attachment manufacturers. It supplies its attachments to Linde, Still and Jungheinrich.